Contrarian Trading with Day-Trading

The “Double Smoothed HYENA”

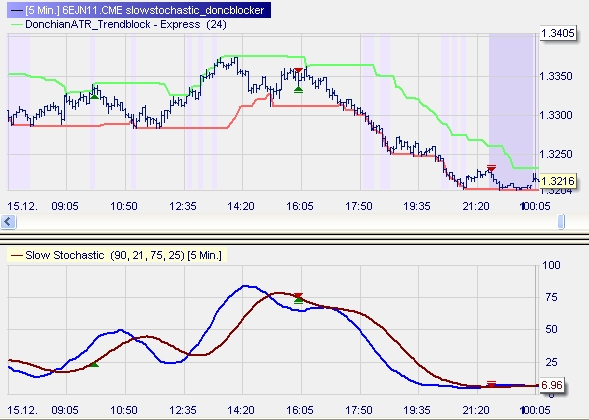

This is a contrarian day-trading strategy with a Slow Stochastic as indicator. This cannot work well on trending days. So we do not enter the market on a day when there are fresh highs or lows (a Donchian Channel Filter). This is for sideways market days (which are even in trending times occurring more often than strong trend days).

Blue line: Stochastic. Red line: Smoothed stochastic that gives signals when thresholds at 25 or 75 are crossed from the more extreme region.

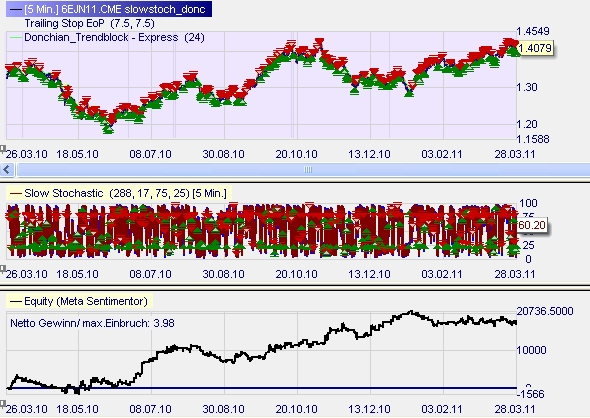

This strategy over a year at the Euro-USDollar. Nice equity development.

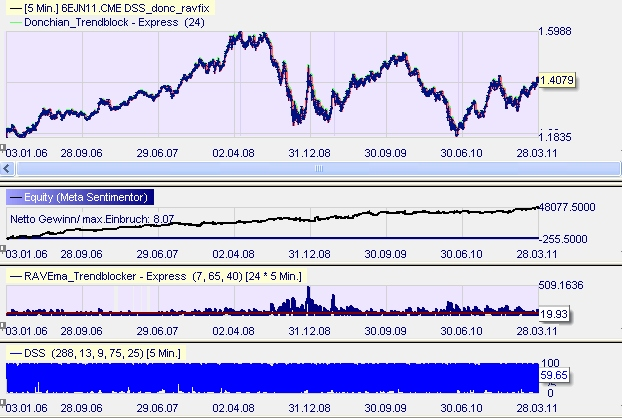

Mit dem Double-Smoothed Stochastic (DSS) instead of hte Slow Stochastic it worked even better.

But watch out: The relation profit to maximal drawdown indicates that there have been some drawdown times as well.

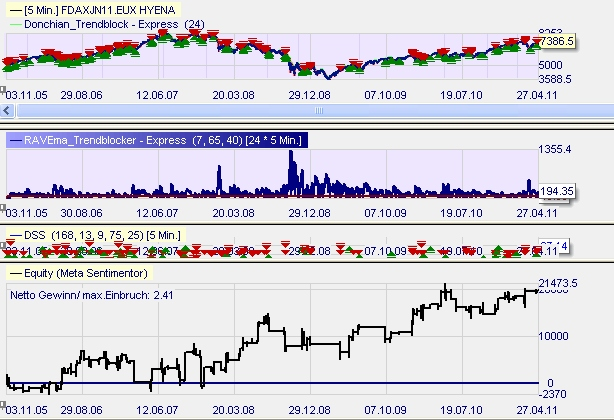

The strategy trades less with the FDAX. But when it does, the trades look good mostly.

(back to chapter 4 overview)