Chapter 4-3

Contrarian Trading with Overbought/Oversold Situations (Dynamic Attractors)

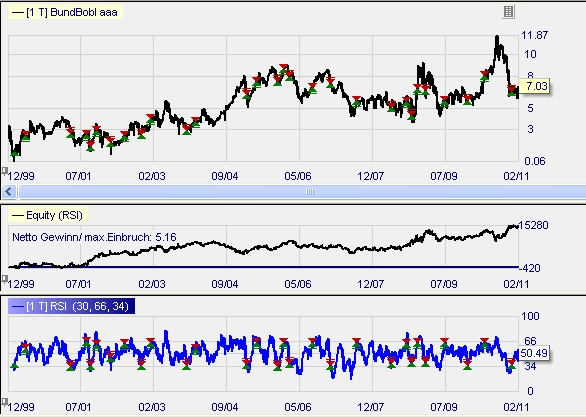

The spread of BUND and BOBL, two German interest markets. Spreads are well suited for contrarian trading as the price difference will come back to “normal” most of the time.

Long term strategy: Trading the BUND-BOBL spread going contrarian by using the simple RSI oscillator, calculated on 30 days. When abonve 66 we go short, below 33 we go long. That would have worked well.

Chapter 4-2

Chapter 4-3