The Oryx

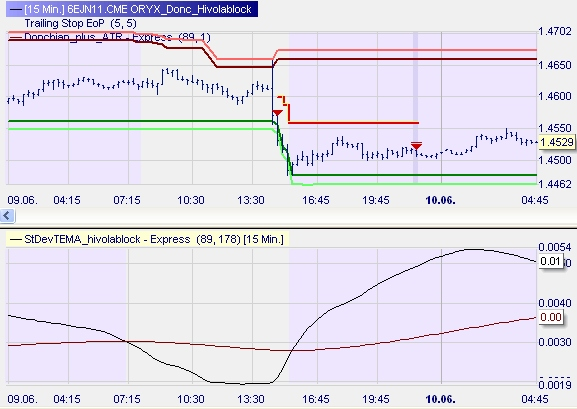

“The Oryx” is a daytrading strategy with a volatility component. Whever the amrekt makes a new daily high or low plus/minus an ATR a trade in the direction of the nwe high/low is entered. If the volatility is very high, we rather not enter. Those trades are blocked by a filter from a Standard Deviation and a TEMA on it. This strategy catches especially outbreaks when the US markets are waking up. Here Euro/US-Dollar

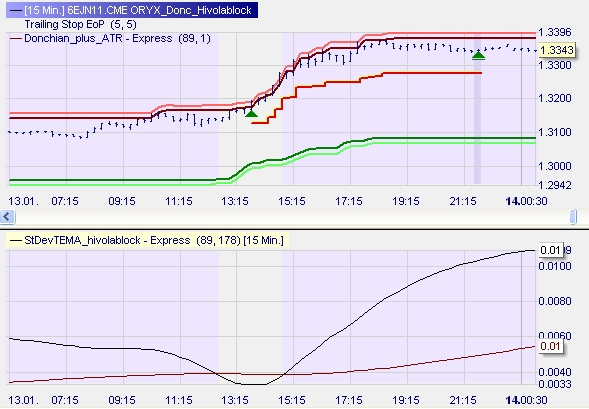

Same approach with a buy signal and a long trade secured by a trailing stop.

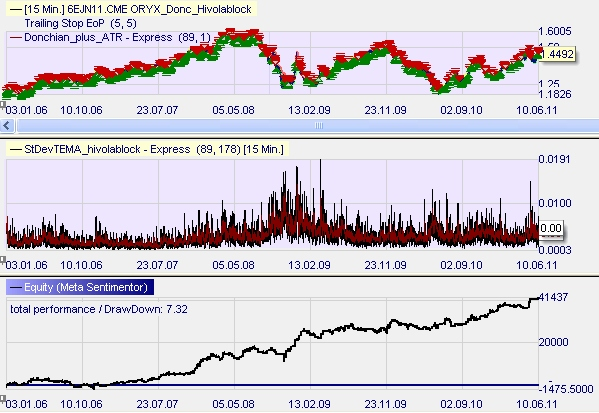

This strategy in a 5 year backtesting has performed impressively.

The Oryx traded with the FDAX during the time of high volatility during the crash of 2008 and the bull market thereafter.

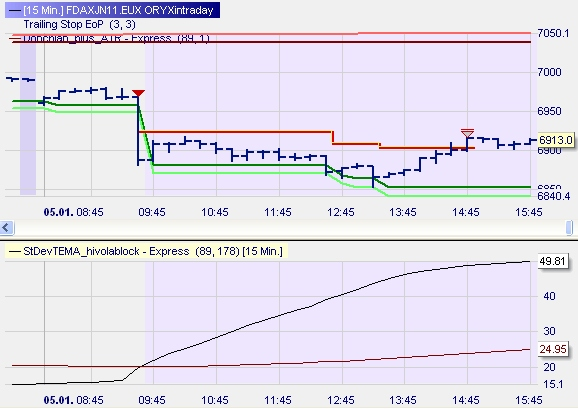

A trade at the FDAX in close view. It is not a very good trade actually, as the entry price is at the close of the long bar. Sometimes the movement stalls after the breakout. It is good to place a stop. But you can see the Donchain Channel and the additional space built by the ATR.